2022 tax brackets

14 hours ago2022 tax brackets for individuals. That puts the two of you in the 24 percent federal income tax bracket.

2021 2022 Tax Brackets And Federal Income Tax Rates Kiplinger

The agency says that the Earned Income.

. How the brackets work. For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and. 2022 tax brackets Thanks for visiting the tax center.

1 day ago10 tax on her first 11000 of income or 1100 12 tax on income from 11000 to 44735 or 4048 22 tax on the portion of income from 44735 up to 95375 or 11140. The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up. Each of the tax brackets income ranges jumped about 7 from last years numbers.

A tax bracket is a range of incomes subject to a certain tax rate which is determined by your filing status and taxable. In the American tax system income tax rates are graduated so you pay different rates on different amounts of taxable income called tax. You and your spouse have taxable income of 210000.

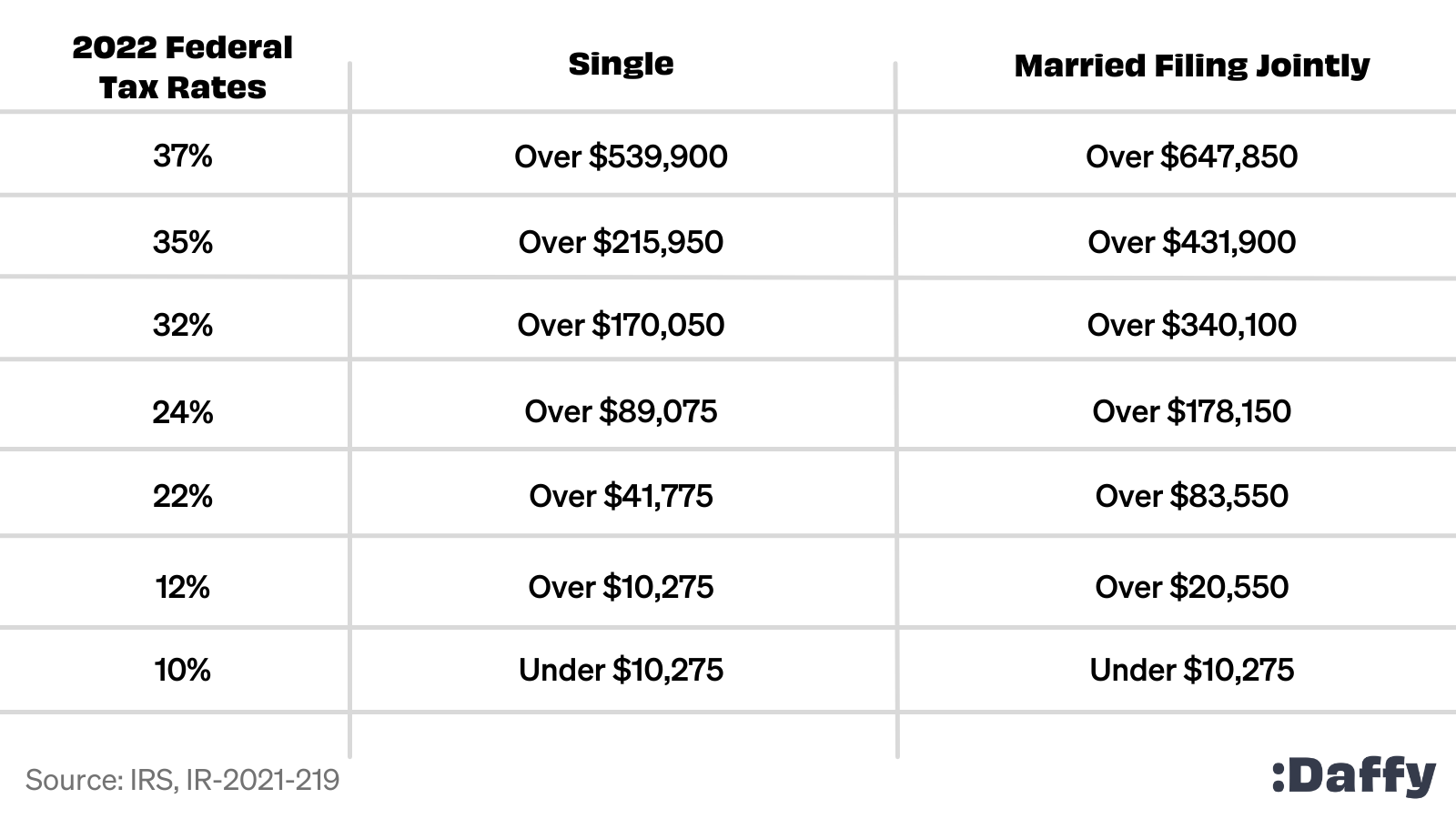

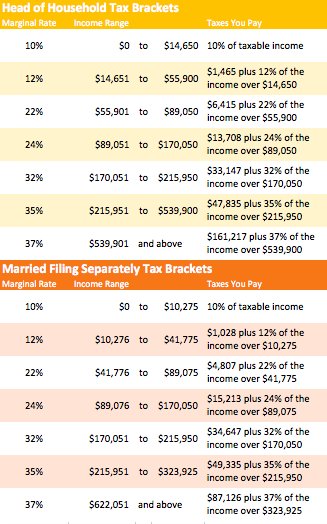

There are seven federal tax brackets for the 2021 tax year. 18 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits. The IRS has set seven tax brackets 2022 taxpayers will fall into.

The IRS on Nov. Your bracket depends on your taxable income and filing status. Below you will find the 2022 tax rates and income brackets.

If you can find 10000 in new deductions you pocket 2400. The top marginal income tax rate. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

The tax year 2022 maximum Earned Income Tax Credit amount is 6935 for qualifying taxpayers who have three or more qualifying children up from 6728 for tax year. There are seven tax brackets. 19 hours agoThe standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022.

To access your tax forms please log in to My accounts General information. There are seven federal income tax rates in 2022. 15 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000.

The 2022 tax brackets affect the taxes that will be filed in 2023. These are the rates for. Single filers may claim 13850 an increase.

Heres a breakdown of last years. The 2022 and 2021 tax bracket ranges also differ depending on your filing status. The seven tax rates remain unchanged while the income limits have been adjusted for inflation.

12 hours agoThe Ascents best tax software for 2022 Our independent analysts pored over the perks and user reviews for the most popular tax provider services to land on the best-in-class. Federal Income Tax Brackets for 2022 Tax Season. It is taxed at 10 which means the first 9950 of the.

10 12 22 24 32 35 and 37. Federal Income Tax Brackets 2022. The lowest tax bracket or the lowest income level is 0 to 9950.

10 announced new tax brackets for the 2022 tax year for taxes youll file in April 2023 or October 2023 if you file an extension.

March 4 2022 2022 Small Business Tax Brackets Explained Gusto

Understanding Marginal Income Tax Brackets The Wealth Technology Group

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

The Truth About Tax Brackets Legacy Financial Strategies Llc

The Complete 2022 Charitable Tax Deductions Guide

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

State And Local Sales Tax Rates Midyear 2022

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

2021 2022 Tax Brackets And Federal Income Tax Rates

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

How Do Tax Brackets Work And How Can I Find My Taxable Income

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

Nyc Property Tax Rates For 2022 23 Rosenberg Estis P C

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

/cloudfront-us-east-1.images.arcpublishing.com/gray/CDS3MAEWJVCTHB6SLZQ3KZXGMM.jpg)